-

-

-

-

-

-

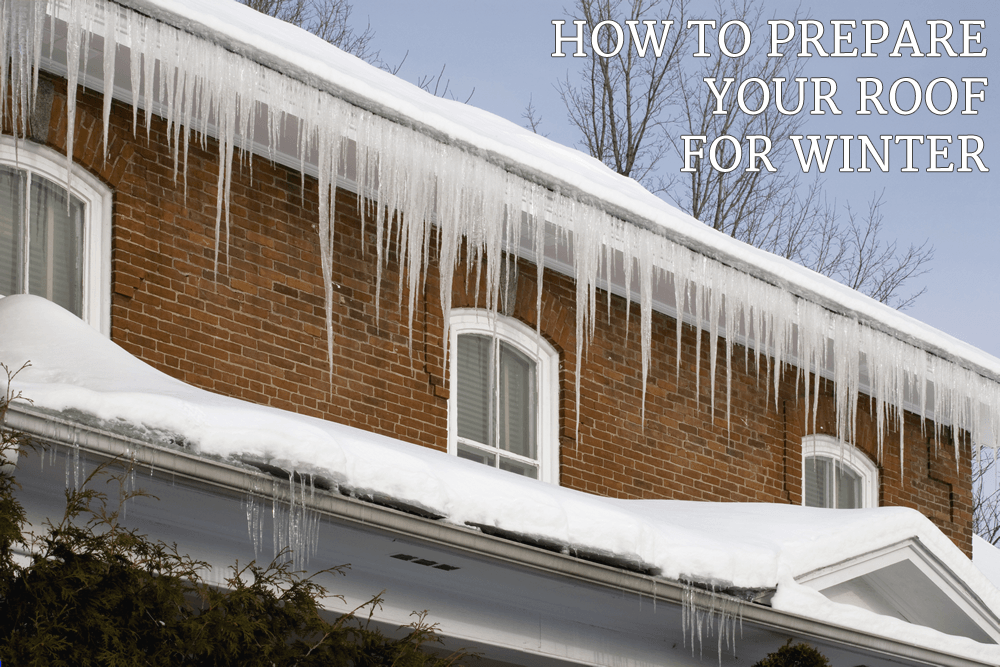

How to Prepare Your Roof for Winter

A house is typically a family’s biggest investment. Routine maintenance on a house is essential for maximum usefulness and longevity. Being prepared for a harsh Kentucky winter is the key to avoiding costly repairs that can add up unexpectedly. One of the main parts of a house that needs to be inspected is the roof….

-

How to Interview a Roofing Contractor

If you have realized that you need something done on your roof, it can be incredibly difficult to decide how to choose an Indiana roofing contractor. Unlike many jobs around the home, there is little that you can do or see when it comes to your roof, and you will only have the word of…

-

-

Roofing Materials Explained

Are you in the process of making choices for your new roof, and pulling out your hair over the myriad options? If so, then you could definitely benefit from a clear break-down of the different roofing materials available to you. Fortunately, you’ve come to the right place. Here are roofing materials explained: Shingles. Shingles are…

-

3 Reasons You Know You Need a New Roof

Replacing a roof is a fairly hefty expenditure for most families and businesses. For this reason, people often put it off for as long as possible. Unfortunately, there are some circumstances in which you should replace your roof right away, no matter what, and whether you want to or not. Do you fit into this…

-

The Best Way to Keep Your Roof Clean

Everyone loves the idea of having a maintenance-free roof, and many roofing manufacturers aim to meet that need by offering products that are as low-maintenance as possible. However, regardless of the type of roof you have, the fact of the matter is that you will inevitably have to perform some routine upkeep on your roof…

-

3 Most Popular Roofing Designs

Although it is true that your roofing designs will certainly not be the first thing you pick out when designing your home, it is undeniable the design of your roof is extremely important to your home’s overall look and feel. Roofs come in a wide array of types and styles, and your roof of choice…